MNEs are incrementally facing the burden of being compliant in view of transfer pricing documentation requirements. Tiberghien economics seeks to provide assistance ensuring your company has consistent transfer pricing documentation, not only from a Belgian perspective but also worldwide, being compliant globally and avoid non-compliance penalties. We are able to offer assistance regarding Belgian transfer pricing documentation requirements, complemented with project management to draft consistent transfer pricing documentation globally. In addition, we have available smart software making transfer pricing documentation more easy.

Tiberghien economics and Reptune® have partnered to offer you a transfer pricing documentation platform which is robust and intuitive at the same time. Reptune® contains a highly sophisticated Transfer Pricing Documentation-writer. It will help you with the coordination and drafting of Transfer Pricing Documentation worldwide. Since Reptune® is a web application, it requires no software installation and is suitable for any operating system. More information can be found on reptune.net, or in the following BROCHURE, and obviously we would be happy to provide you with a free of charge demo.

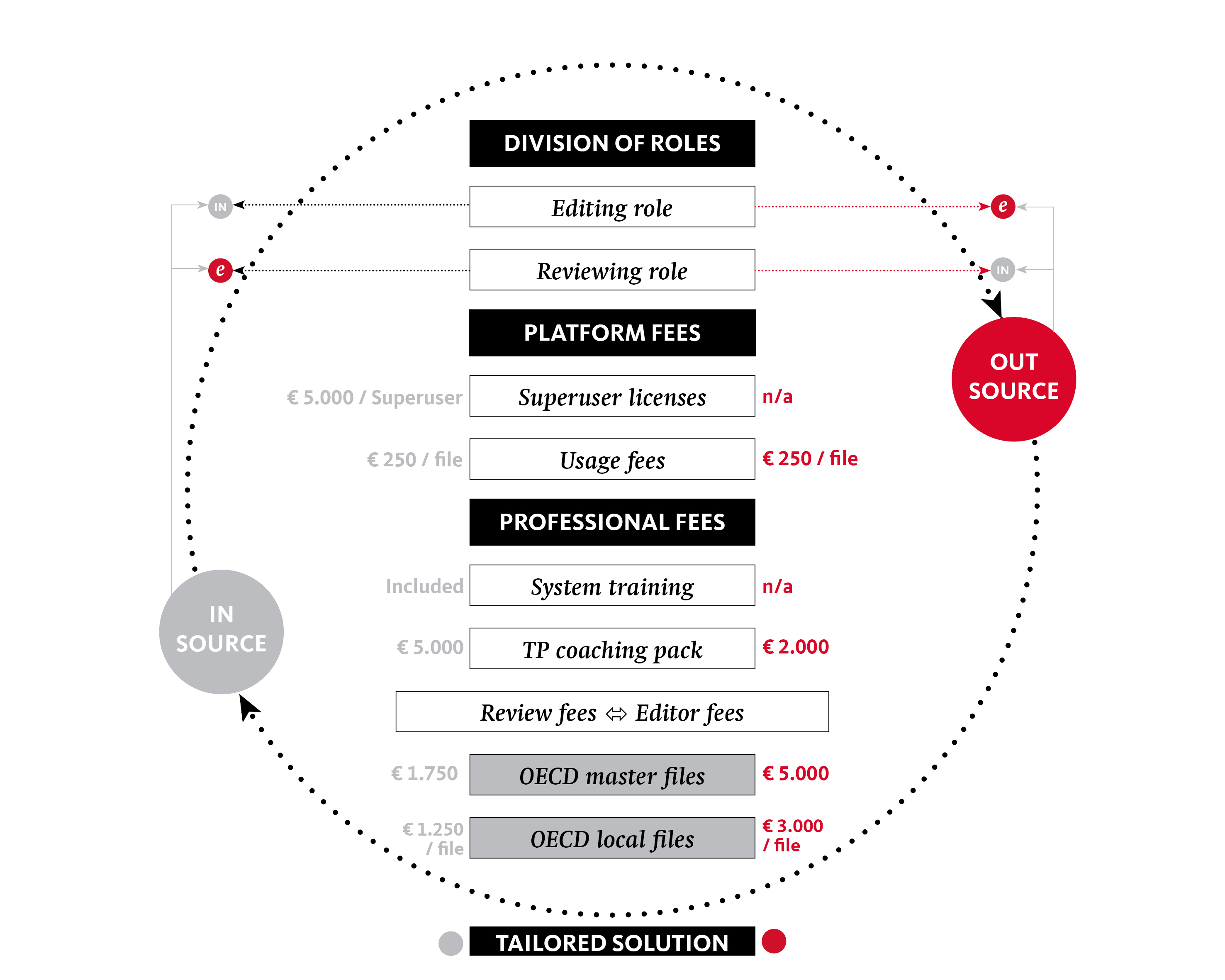

We have developed two standard offerings, but obviously can tailor the solution and agree on a service level agreement to fit your needs and ability to take the extent you desire to control the editing process in-house, with Reptune®'s and our expert support.

- INSOURCE – You use the Reptune® tool yourself and will have full access to the software platform enabling to draft and edit all documentation (OECD Master File and/or OECD Local Files) needed within your group of companies. Tiberghien economics' role will be limited to reviewing the reports you have drafted, to assure they are aligned with the requirements of the OECD Transfer Pricing Guidelines, directly incorporating our comments and recommendations in the Reptune® platform.

In practice, for reasons of succession, we recommend two Superusers to be assigned within your group to draft transfer pricing documentation reports. These Superusers will be trained by Reptune® to empower them to fully take advantage of the platform, including monitoring performance dashboards, and will have access directly to a technical helpdesk organized by Reptune®. The standard insourcing model also includes a transfer pricing coaching pack where our seasoned transfer pricing professionals will assist you on addressing issues with the interaction of your content with the underlying regulatory principles, including guidance on the selection of transfer pricing methods applied for each intercompany transaction and our findings and recommendations on the transfer pricing policies applied. This way of working will allow you to draft the transfer pricing reports in the most cost and time efficient manner.

- OUTSOURCE - Tiberghien economics drafts an OECD-based Masterfile and OECD-based Local Files using the Reptune® tool.

In this model, Tiberghien economics acts as the Superuser, and accordingly platform fees for you only relate to the usage fees on a per file per annum basis. Nevertheless, you will have access to the Reptune® tool, for uploading required data and for review purposes. Actually, all the labor to be done will be taken care of by our seasoned transfer pricing professionals, but communication will occur through the platform so that you can continuously monitor progress. The standard outsourcing model also includes a transfer pricing coaching pack, whereby we will make available to you our findings and recommendations on the transfer pricing policies applied, in a pragmatic manner.

Typical intake process:

We kick-off with an introduction call to get an initial view on the relevant facts at hand, as well as to discuss our preliminary thoughts on possibilities for your company in managing your transfer pricing compliance. This call is free of charge. Next, we will prepare a tailored project approach for your company which generally consists of the following steps (we follow a sequential process in view of efficiency):

- Assess TP documentation requirements for each of the countries your group is active in

- Assess the current status of the transfer pricing documentation already available within your group

- Draft transfer pricing documentation globally using Reptune® as a transfer pricing documentation-writer

- Alternatively and/or in addition, we can assist you with the coordination of global transfer pricing documentation projects and ensure local reviews of transfer pricing documentation reports you have already drafted.

Your key contacts

Tine